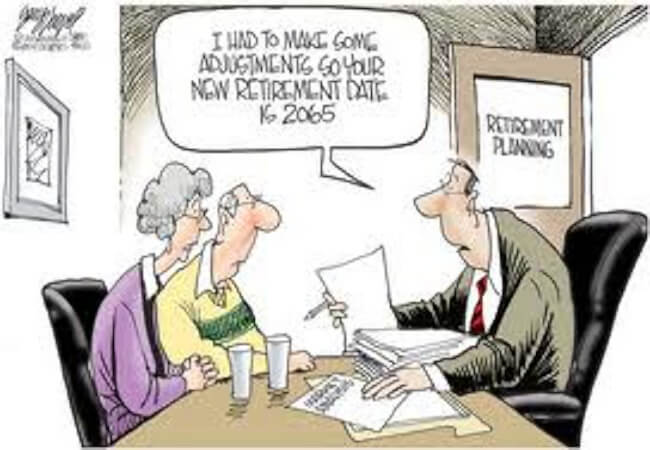

MILESTONE 9: Are you ready? RETIREMENT !!!

With people living longer, marrying and having children later and not saving enough, facing retirement is a challenge. While there is growing awareness about the need to plan, less than 5% are prepared for retirement and fail to take into consideration inflation rates and rising medical costs. ~ The Star, Sunday May 27, 2007

Everyone grows old. The question is, will you be ready when retirement gets here? We all know it’s coming, but unfortunately, few of us are adequately prepared for its arrival. You might be thinking, why should I think about retirement now? I’m young and fit, I can think about it later. This procrastination can be a costly and financially dangerous mistake. Everyone should be looking to the future and planning for the day that they will no longer want or be able to work to earn a livelihood. The fact is, average life expectancy of Malaysian is 73.79 years.

Furthermore, those individuals who think Employee Provident Fund(EPF) will be enough to support their retirement are fooling themselves. There will always be a need to supplement this government provision. Individuals who plan their retirement are able to supplement this base income with other sources that greatly improve income potential over the course of a retirement. Here are 6 ways to prepare for retirement.

RECOMMENDED FINANCIAL MOVES:

1. Prepare For Retirement

Know what you need for retirement. Plan on needing 70% to 80% of your pre-retirement income to maintain the style of living you are accustomed to. If you plan on traveling, golfing, or other activities add those expenses into your needs assessment.

2. Find Out About Your EPF Retirement Account

What will you receive from EPF? Some studies have shown that most retirees spend all their EPF (Employee Provident Fund) money within 3 years of their retirement. Let’s say we retired at 55 and if Malaysian average life expectancy is 73.79 years the question is how to survive from 58 years onwards? Find out how much your benefit is by asking for a individual benefit statement. Keep close track of all of these benefits.

3. Set up Your Own Retirement Planning

If your EPF does not offer a sufficient retirement fund there is still hope. Simple plans can be set up, easily, by some service providers. Ask your financial advisor which is the best option for you. Contact us and ask about choosing a customized retirement solution for you.

4. Pay Yourself With Personal Savings Accounts

Deposit into your savings account just like it was a monthly bill. Then DON’T TOUCH IT!!! It is there for a ‘rainy day’ but keep your hands off of this money for things you ‘want’. Treat your savings account this way and watch it grow.

5. Set Goals to Prepare For Retirement

You know how much you need to retire so set goals for each of the above options. Know how much you can afford to contribute to your EPF and savings plan then stick to it. As your financial income grows, so should your contributions. This is you taking care of you.

6. Keep Informed and learn the Knowledge

Inflation will play a significant role in retirement finances. Understand that the type of investments you make play an important role in how much you save and how long that will cover your retirement with inflation in the equation. Know how your all your plans are invested and keep track of your benefit statements. This is something you need to consult your financial advisor on.

To get practical advice talk to everyone who is playing a role in your retirement plan. This includes your employer, bank, union, former employers and financial advisor. You need to understand all the saving options available for you and you need to start saving now.

Retirement: It’s nice to get out of the rat race,

but you have to learn to get along with less cheese. ~Gene Perret