Flat rate loan vs flexi rate loan, which is better?

In this topic, we will explore the difference between flat rate (fixed rate) and flexi rate(floating rate) loans available in the financial market. In what circumstances should you choose a flat rate loan, and when adopting a flexi rate loan is to your advantage ?

Flat rate(fixed rate) loan

As the name implies, the interest rate of the loan is fixed for the whole loan tenure, what it means is that you just need to pay the same installment amount year after year without worrying on the interest rate fluctuations.

In financial planning terms, paying a fixed installment amount also provide the comfort for cash flow budgeting purpose, while the basic salary increase over time, paying the fixed installment amount allow you better manage your finances.

Flexi rate(floating rate) loan

In Malaysia banking system, the flexi(floating) rate is a function of

Flat rate(fixed rate) loan

As the name implies, the interest rate of the loan is fixed for the whole loan tenure, what it means is that you just need to pay the same installment amount year after year without worrying on the interest rate fluctuations.

In financial planning terms, paying a fixed installment amount also provide the comfort for cash flow budgeting purpose, while the basic salary increase over time, paying the fixed installment amount allow you better manage your finances.

Flexi rate(floating rate) loan

In Malaysia banking system, the flexi(floating) rate is a function of

[Base Lending Rate(BLR) – loan spread] eg BLR – 2.3%

The loan spread is very much subject to individual borrower credit history and may be altered if the borrower failed to make the loan installment on time.

In the current relatively low interest rate environment, many borrowers are attracted to take up loans with the flexi (floating) rate package due to lower monthly installment. However, the questions is how long more will the interest rate remain at all time low ?

The loan spread is very much subject to individual borrower credit history and may be altered if the borrower failed to make the loan installment on time.

In the current relatively low interest rate environment, many borrowers are attracted to take up loans with the flexi (floating) rate package due to lower monthly installment. However, the questions is how long more will the interest rate remain at all time low ?

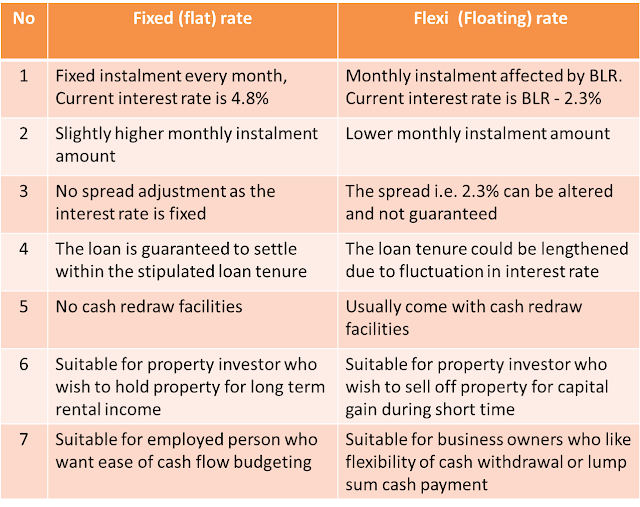

What are the impact of interest rate movement to the installment ?Below is a comparison chart that would illustrate the difference of 2 type of loan packages.

Hi Samantha,

Fixed rate loan are better for long term cash flow management. It is good for budgeting even in short term the loan interest rate is slightly higher than flexi rate. Drop us a mail at customer.care@prajna-advisors.my if you need more personal consultation. TQ