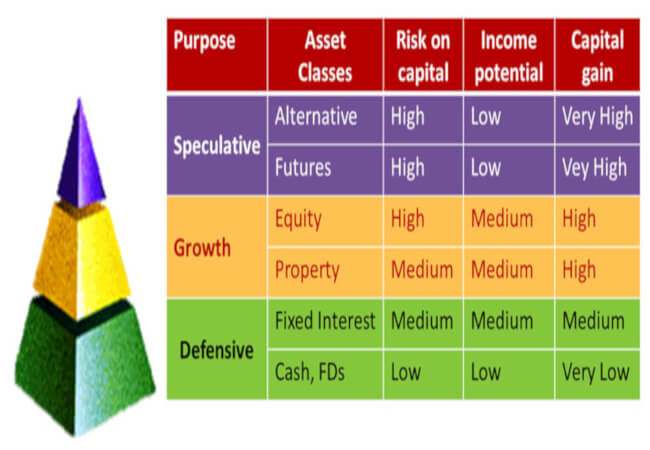

Know your investment asset classes

Know your investment asset classes

Investing in different asset classes is a good way to reduce risk. By spreading your funds across different asset classes you remove the risk of putting all your eggs in one basket – i.e. the risk that you will choose the wrong asset class at the wrong time.

Cash

Cash is the generic term for investments such as bank savings or fixed deposits.

Cash is considered the least risky of the major asset classes – generally providing investors with a low interest income, but little chance of capital gain.

Good

No capital loss and cash reserves can quickly be converted to satisfy whatever need at hand.

Bad

Cash will be eroded by inflation over time and it has the lowest returns of the major asset classes.

Risk / Return

Risk = Low ; Return = Low

Time horizon

Cash is useful over any time frame, but only keep an amount sufficient for 6 months of expenses.

Fixed interest

Fixed interest investments, or bonds, are effectively I.O.U. (loans) issued by an entity such as a company or government. In exchange for your loan, the bond issuer will pay you a guaranteed stream of interest over the loan period, plus you’ll get your original stake back after an agreed number of years.

Good

Government bonds are much less volatile than equities and provide better return than cash. It usually work inversely to share equities movement so it is a useful way to protect against stock market crashes.

Bad

Bond returns historically are lower than equities make it vulnerable to inflation. Typical bond is bought is big ticket size which is only available to institutional investor. Individual investor can invest in a bond fund.

Risk/Return

Risk = Lower than equities, higher than cash ; Return = Lower than equities, higher than cash.

Time horizon

You can match your bond holdings to any time horizon and know exactly what your return will be, if you hold the bonds until maturity.

Property / real estate

Property is considered a growth asset, and involves investing in residential or commercial property, or via a real estate investment trust (REIT). REITs invest in a range of property – including residential housing, shopping centres, office buildings, factories, and hotels. As property is a growth investment, capital gains may be expected over the long term, in addition to on going income from rent.

Purpose

Provide both a hedge against inflation and low “correlation” to stocks — in other words, it may rise when stocks fall.

Good

Historically, property is likely to keep pace with the rate of inflation.

Bad

Miscellaneous costs are involved in property maintenance such as service fees, sinking fund, insurance, assessment. Property is considered moderately volatile. Furthermore, property is illiquid and can’t be sold off quickly if everyone wants their money back.

Risk/Return

Risk = Higher than bonds or cash, but lower than equities ;

Return = Higher than bonds or cash, but lower than equities

Time horizon

In general 5 years is the optimum holding period.

Commodities futures

Investing in commodities is the business of predicting on the price movement of goods in the future. Typical commodities include :

- Agriculture e.g. wheat, corn, soybeans, cotton, sugar, coffee, cocoa

- Livestock e.g. live cattle, feeder cattle,lean hog, pork belly

- Energy e.g. oil, gas, petrol, heating oil

- Industrial metals e.g. aluminium, copper, nickel, lead, tin

- Precious metals e.g. gold,silver, platinum

Help to accelerate the growth in your investment values. It serves as an equity diversifier.

Good

A good inflation hedge. It can reduce portfolio risk as commodities like gold does not move directly related to equities.

Bad

The workings of commodity future contracts can be complicated.There is no long-term source of return for direct commodity exposure as commodities don’t pay dividend.

Risk/Return

Risk = Higher than bonds, property or cash. Similar to equity

Return = Inconsistent. Use as a method to reduce the risk of equities.

Time horizon

Depending of type of commodities, the time horizon varies from days to months.

Alternative assets

Investing in alternative assets is another form of price movement prediction of a particular assets. This asset classes are more of speculative in nature and for the strong heart who can stomach high volatility and risk. The assets include :

- Hedge funds

- Currencies

- Index e.g. the “Fear Index”

- Collectibles e.g art, wine, antique cars

Help to accelerate the growth in your investment values. It serves as an equity diversifier.

A good inflation hedge. It add to a diversified portfolio.

Bad

Illiquidity or other barriers to entry/exit. A high degree of expertise is required to avoid being manipulated by other market syndicate players.

Risk/Return

Risk = Higher than equities

Return = Inconsistent. Use as a method to reduce the risk of equities.

Time horizon

Depending of type of assets, the time horizon varies from minutes in Binary Options to years in wine or art pieces.