There is a saying, “You rather have insurance when you don’t need it, than when you need it and you do not have it.” There is no surprise there are bound to be people who disbelieve. After all, formal education trains us to be logical and not emotional. It is until […]

Read morePosts archive for 2012

INVEST FOR SUCCESS – Pitfalls to avoid in property investment

After having a better understanding to obtain initial seed capital to invest in property through ZERO DOWN strategies, the next thing we should turn to is to take care of the LAND MINE in property purchase. In this article, we will explore some pitfalls and good practice in property purchase […]

Read moreZERO DOWN Investment Strategy 5- Power of Auction

Buying property at a auction seems to be one of the last option for many people, mainly because we are not familiar with the mechanisms and workings of the auction house. Nevertheless, many will agree buying property at auction is one of the best way to acquire a property at […]

Read moreZERO DOWN Investment Strategy 4 – Power of Statutory Savings (EPF)

For many working employees, it is mandatory for you to contribute a portion of your monthly income to a statutory savings provident fund call Employee Provident Fund (EPF). At the time of writing, the employee portion (you) will require to contribute 11% of your monthly income […]

Read moreZERO DOWN Investment Strategy 3 – Power of Landlord

If you are currently renting a house and you like the surrounding environment, the facilities, the location but cannot afford to buy the property, then this could be a strategy you can consider.Build a good rapport with the landlord, of course, you need to be a good pay master, pay […]

Read moreZERO DOWN Investment Strategy 2 : Power of the Bank

After seeing the power of leverage of credit card, let’s turn our attention to a conventional lending mechanism, the bank as financial institution. Ironically, a normal person will put our hard earning money, savings in the bank which in return for a small amount of interest gain. And, we then […]

Read moreZERO DOWN Investment Strategy 1 : Power of Credit Card

After understanding the purpose why typically Asian in general and Malaysian in specific likes to invest in properties, we have researched and compiled some commonly used strategies how a property investor investing WITHOUT taking out a single sen from their pocket through the ZERO DOWN investment method. What, Investing using […]

Read moreInvesting in properties, anyone ?

A typical person normally have different investment vehicles, be it the more commonly understood share markets / mutual funds related , precious metals like gold, silver to favourite of many – property. There have been many advocates and reasons as to why property investment is favoured. Many successful business people […]

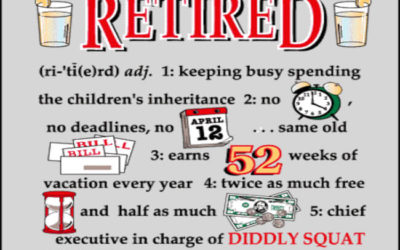

Read moreMILESTONE 10: Hurray! Retiring…

MILESTONE 10: HURRAY! RETIRING RECOMMENDED FINANCIAL MOVES: So after all the planning, investing & making all the recommended financial moves towards 10 lives major milestones and we should be able to enjoy our retirement. As we always said, either we enjoyed the retirement or retired from enjoyment. The only concern […]

Read moreMILESTONE 9: Are you ready? RETIREMENT !!!

MILESTONE 9: PREPARING FOR RETIREMENT With people living longer, marrying and having children later and not saving enough, facing retirement is a challenge. While there is growing awareness about the need to plan, less than 5% are prepared for retirement and fail to take into consideration inflation rates and rising […]

Read more